Did you know the age for retirement is 67 years old?

Can you imagine working until you’re 67 years old?

Of course, you may have a job you love and want to work at until you physically (or mentally) are not able to. Maybe you just love staying busy, so you see yourself working at a job, any job, for as long as you can. Maybe you just don’t plan that far ahead, so you’re not worried about it.

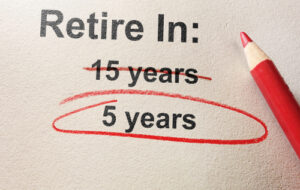

What if you could start habits now that would give you a chance to retire earlier than when you are 67 years old? We’re not talking retire at 64 or 63 – we are talking about retiring when you’re in your 50s, and maybe earlier.

The thought of being able to retire early, where you are living comfortably without having to work, is exciting. More important, it is possible, if you start doing these things now.

-

Think About Your Future Self

People are notoriously bad at planning for retirement. It is difficult to imagine yourself so far into the future because there is so much going on in the present. Before you start doing anything, you must understand that who you are 20 years from now is just the present you x 7,300 days. How many times have you said, “I wish I would have done this earlier?”

You need to set your future self up for success, and that means making every decision with that in mind. You don’t need to go too extreme and struggle now just for the sake of it, but you must evaluate how the money you have now is going to help you in the future.

-

Set Your Goals Now and Work Backwards

After you’ve changed your thinking to keep the “future you” in mind, the next thing is to create a goal for when you want to retire. Once you decide whatever that age is, you can work backward and determine how much you need to be saving to reach that goal.

-

Start Today with Saving Automatically

Start saving money immediately. Don’t save too much (you still need money to live today) but automate a percentage of your paycheck to go into a savings account. It could be 10%, it could be 20% – whatever you can live without for right now and still live comfortably. Once you automate the process (where it goes into your savings without you having to manually do it), you’ll get used to not relying on that money, and it will teach you to manage the money you have and let the savings build up.

This could be done whether you are in a job that has a 401(k) or not.

-

Contribute the Max to Your 401(k)

If you’re in a job that has a 401(k), contribute as much as you can. If your employer matches whatever you contribute, make sure to at least match their donation. It maximizes the amount of money going in every month, and it will build up value over time.

Even if your job does not offer a 401(k), there are other options like a Roth IRA that you can open on your own.

-

Track and Control Your Spending

Once you have either your savings or 401(k) set up (or both), the next step is to track and control your spending. For the money you are not putting away every month, evaluate where you are spending It and how you can cut down on any unnecessary spending. Bills are important – fancy toys are not.

Make a budget and stick to it. Also, even if you budget properly and you find you can spend money on a shiny toy, ask yourself “What would future me think about this purchase?” The answer may cause you to re-think your purchase, and your future self will thank you for it.

-

Invest

Investing is a smart financial strategy when done correctly. You can get a return of around 10% by investing in stocks, and the sooner you start investing, the more money you will likely have to work with. You can approach investing in one of two ways…

- Spend time learning about the Stock Market and play the stocks yourself

- Have a financial expert do the investing for you

Both options have their pros and cons, but if you’ve never really been interested in money, it’s best to leave it up to the professionals. Talk to your bank or a financial planner and find out your options for investing.

Retirement is a luxury that many of us hope to enjoy one day. Habits like the above are easy to implement immediately to see a drastic return on in the future. The sooner you can retire, the more time you must enjoy the freedom of not having to work and just being able to live.

Leave A Comment